Industrial rents have improved significantly in recent quarters despite the difficult economic environment.

This is the third consecutive quarter that the JTC All Industrial Rental Index has increased. While this is going on, CBRE Research also found that ground-floor manufacturing and warehouse rents rose in Q2 2021.

Strong industrial production and robust demand are anticipated to keep occupancy and rentals on the rise.

The semiconductor manufacturing sector, pharmaceutical and biomedical industries, as well as the growing trend of e-commerce and online grocery shopping, are all expected to boost demand for industrial space in the near future.

Strong Demand from Semiconductor Sector

As well as supply-chain problems, the current worldwide chip shortfall has been compounded by increased demand for semiconductors from cloud services and the 5G industry.

Due to Singapore’s 5% worldwide wafer manufacturing capacity and 19% global semiconductor equipment market share, the shortfall may benefit industrial companies in the electronics industry.

A rise in production volumes may necessitate an expansion in factory and warehouse space needs when semiconductor manufacturers commit to greater capital expenditures. Earlier this year, GlobalFoundries, a US semiconductor company, revealed plans to spend S$5 billion in Singapore to expand its wafer manufacturing facility.

Smaller semiconductor firms are also expanding and renewing their contracts, which is encouraging. In areas like Yishun, Ang Mo Kio, and Woodlands, well-known electronics clusters, you’ll find many of these companies based.

These locations are particularly attractive to companies in the downstream value chain since they are close to the manufacturing sites and suppliers, which may help keep costs low for the whole value chain.

Strong Demand from Biomedical and Pharmaceuticals

Pharmaceutical and biomedical commerce have been especially robust in Covid-19 beneficiary sectors during the last three quarters.

There are pharmaceutical firms in the city-state that produce four out of the top 10 worldwide revenue-generating medicines, according to the Singapore Economic Development Board. By using the “build to fit” approach, companies are saving money on initial capital while still getting exactly what they want out of their properties. In the Tuas Biomedical Park, the French pharmaceutical company Sanofi plans to construct a vaccine manufacturing facility and a laboratory.

Multi-user projects, such as JTC Space @ Tuas Biomedical Park, on the other hand, can accommodate large companies as well as small and medium-sized businesses with fewer space needs. Consequently, a clustering effect will be created and the biomedical manufacturing ecosystem of R&D centers and technology partners will be enhanced, resulting in the construction of future-oriented factories.

Strong Demand from Ecommerce Sector

As a result of the epidemic, consumer habits have shifted in favor of online shopping.

As predicted by Euromonitor International, Singapore’s internet sales volume is projected to rise by as much as 80% from pre-Covid-19 levels by 2021, and by 13% CAGR from that year to the next. As a result, there will be an increase in the need for warehouse space.

Commitment rates for new or future storage facilities have been between 50 and 70 percent in recent months.

Warehouses are concentrated in Tuas and Pioneer in the western portion of Singapore. Approximately 91% of future warehouse supplies will be based in this area, which is expected to grow in importance.

There will be three times as much cold-storage space leased in key Asian markets by the first half of 2021, according to CBRE Research.

Grocery merchants supported by e-commerce platforms, conventional grocers becoming omnichannel, and specialized cold-storage service providers drove leasing activity. There will be an increasing need for cold-chain logistics as customers want better-quality and more diversely-sourced foods and the pharmaceutical sector grows.

Because of the present shortage of specialized cold storage units compared to the expected increase, more developers are beginning to create requirements to meet this need..

So that tenants who need temperature-controlled rooms may adapt as their requirements change, developers might provide adequate power supply.

Confident Prediction

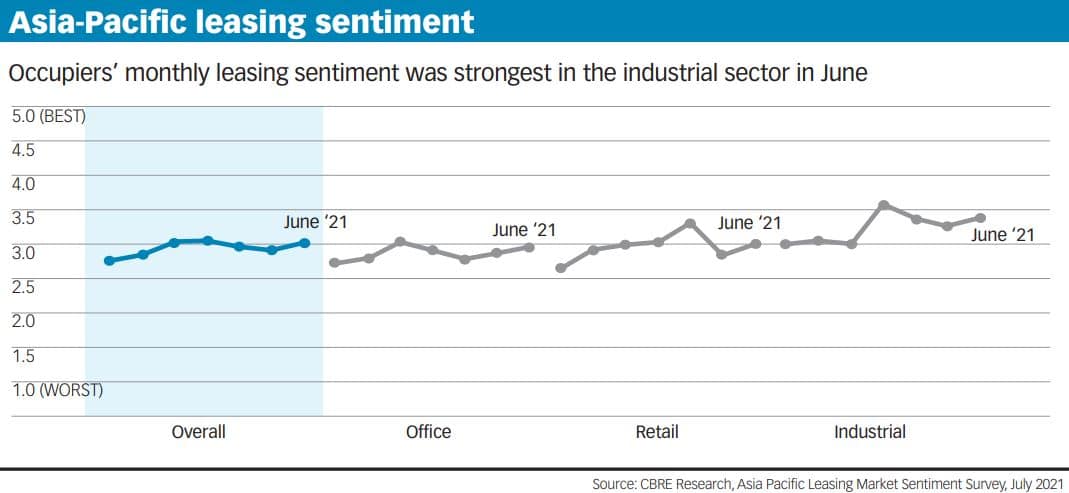

CBRE Research predicts that mood among Asia-Pacific occupiers would improve in the short to midterm as the economy recovers. Asia-Pacific industrial occupiers’ leasing mood was the most upbeat in July, according to a CBRE Research study, beating both the office and retail sectors.

As a result of Covid-19’s economic disturbances, occupiers are worried about rising costs of gasoline, transportation, and labor. CBRE Supply Chain Advisory found that transport costs account for 45 to 70% of all logistical expenses incurred by occupiers.

Logistics facility location is critical because it impacts the company’s ability to serve the whole value chain, including customers, employees, vendors, and logistics partners alike.

Modern construction (ramp-up warehouse constructions) and high standards in ceiling height and floor loading will assist to simplify operations. These are important.

However, the number of vacancies in these types of buildings is very minimal. Prime logistics buildings in Singapore were 99.6% occupied in the second quarter of 2021, according to CBRE Research. On top of that, warehouse supply pipelines remain quiet, with a 10-year historical average supply of 3.86 million square feet per year falling to 2.24 million square feet this year.

Because of this, tenants seeking premium logistics space will have few options.

It is important for tenants to plan and commit to space needs early on, while owners should think about updating existing assets to Industry 4.0-compliant specs. The disruption to the supply chain is expected to persist, therefore businesses will have a greater need for warehouse space as a result of improving supply chain resilience. Prime logistics or high-spec assets rental reversions are anticipated to remain robust against a background of limited vacancies.

Rents for premium logistics facilities are expected to rise by 5 to 6 percent by 2021, according to CBRE Research. Increased investment as a result of this, as investors seek for new opportunities and diversification.

Manufacturing and logistics industries’ resilience throughout the pandemic and anticipated expansion have made industrial assets more in demand since the second half of 2020, according to analysts.

A study conducted by CBRE found that investment sales volumes in Singapore’s industrial sector rose to S$3.9 billion from S$3.2 billion between July 2020 and June 2021. Blackstone spent S$176 million on The Sandcrawler, AEW Fund spent S$142 million on Admirax, a high-spec Business-1 facility, and ESR-Reit spent S$112 million on Global Trade Logistics Centre, a warehousing facility. Investments like this show a large number of institutions are interested in the industry.

Investing in Space 21 – City Fringe Freehold B1 Industrial

Located in the heart of District 14, SPACE 21 is a prestigious new industrial development. A unique Freehold B1 Industrial Building with five floors and 19 apartments, including a cafeteria on the ground level, is available for sale.

It’s becoming more difficult to find new freehold industrial developments. There will be more sites issued with shorter tenures and lower sizes in 2012, according to the MTI. As a result, the maximum land tenure under the Industrial Government Land Sales (IGLS) program has been lowered from the previous 60-year lease period to 30 years. This is a fantastic long-term investment property that may also be used for personal purposes.

Work processes are optimized because to thoughtful arrangements in the units. A 7-meter ceiling height (lower 3.6m, upper 3.4m) is provided in each of the 19 units, making it possible to arrange the space in various ways to suit the requirements of the company. There is also a bathroom facility connected to each apartment.

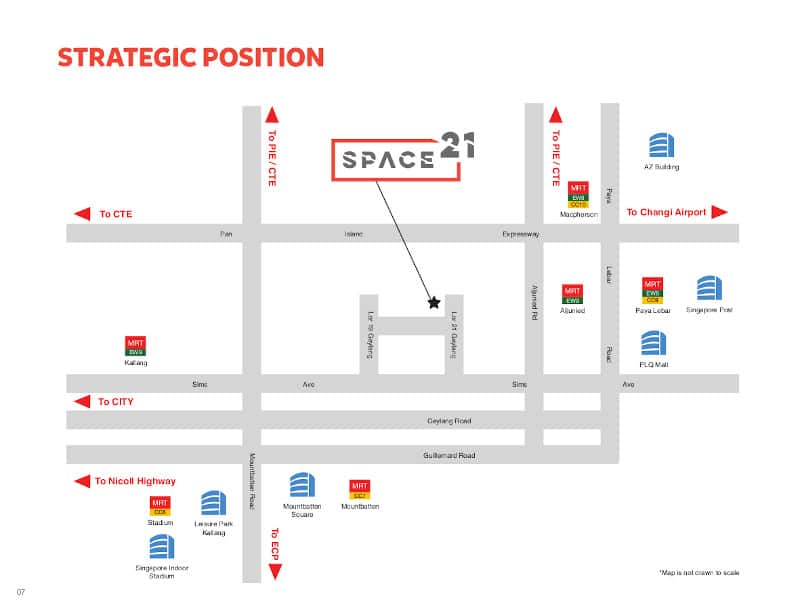

Strategically located in District 14

District 14’s Geylang and Sims region, on the eastern edge of Singapore’s Central Region, is home to Space 21. The Aljunied MRT Station is 400 meters away, or about 5 minutes walk, and bus stations and a bus terminal are nearby. The site has an excellent connection to the rest of the island thanks to CTE, PIE, KPE, and ECP, among other options. As a result, the area sees a lot of people.

Within walking distance of Space 21, you’ll find hawker centers and renowned restaurants in Aljunied, Sims, and Geylang. PLQ, Paya Lebar Square, and Singpost Shopping Malls in Paya Lebar are all within walking distance, as are the Stadium, Singapore Sports Hub, and Kallang Wave Shopping Mall. Singapore’s Space 21 is ideally situated among commercial districts, including the Central Business District and the thriving Paya Lebar Business District. The Changi Business Park and Changi Airport are also easily accessible by car. Being near to business partners, suppliers, and customers has a number of advantages for companies. Space 21 is also close to HDB estates, making it convenient for employees to go there. Employers will have an easier time filling open positions.

In my opinion, investing in Space 21 is a wise move. The stratum size of the unit is about 2,500 square feet, and the price per square foot starts at $860. It’s an excellent investment for renting or using yourself because of the cheap price and low quantum. Furthermore, purchasers are exempt from paying Buyer’s Stamp Duty (ABSD)!

Singapore’s District 14 (including the neighborhoods of Geylang and Sims) lies on the eastern edge of Singapore’s Central Region, home to Space 21. The distance from and to Aljunied MRT is about 400 meters or 5 minutes of brisk walking, and connection island-wide through CTE, PIE, KPE, ECP, etc. is quick and easy. One of the best long-term real estate investments you can make.